Receiving and sending money through online mediums is a common practice these days, as it allows people to send and receive money directly into their bank accounts, omitting the need for ATMs. Apply Pay and Venmo were the initially launched apps to promote the same but were not in the users’ reach due to some limitations of Google Pay.

Overcoming all of these limits, Google launched its app, Google Pay, for the same. Now, everyone can easily send the payments and receive them digitally, without any complications. There are some facts about Google Pay, either related to its working or Google Pay customer care helpline number, that its users must be aware of.

- Tez App:

Google’s digital payment app was launched under the name Tez to join the league for digital wallets and handle digital payments in India. Later, it was renamed Google Pay and relaunched with some additional features and expansion plans for the payment market in India and other countries.

- Workings of the Application:

There are many alternates available for digital payments, but most of them work on their wallets, where the payment will first be received in the wallet and later transferred to the linked bank account. Also, they used to charge a nominal rate for the transfers. Google Pay thus eliminates this rate, as it gives the option for direct bank transfers and receives.

Also, a person does not necessarily need to have the app to get the payments. You can even transfer through the website as well. It offers a simple login process. All you need to do is link your bank account and set up a UPI pin for security purposes.

- Google Pay features:

Google Pay offers instant transactions at just a click and is secured with Tez Shield, providing 24/7 protection and facilitating highly secured transactions. The app is available in eight different languages and can be used for all types of bank transfers. It also provides attractive cashback and scratch offers on all the transactions directly linked to the bank accounts.

- Google Pay vs. Other UPI Apps:

Google Pay first eliminates the need for wallets and cuts out the transfer charges from a wallet to a bank account. This has thus increased its usage, and people have found it useful for cashless transactions. Also, it does not require a KYC completion process before the start. The user only needs to add their bank account for feasibility.

Google Pay’s direct collaboration with state and central government also allows the app to work for government payment options, electricity bills, and many other utility functions.

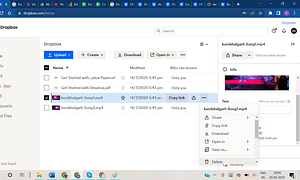

-

Google Pay customer care helpline number

If you are using the services through the app, then you can find the customer number on the dedicated page of the app and will also be able to find other mediums to contact them. And if you are using the same information from the website, you can search out the customer care number online.

What Are the Points You Need to Be Aware of Before Relying on Google Searches?

As mentioned, if you are using the services of the digital wallet through the website, and in case you are looking out for the Google Pay customer care helpline number, you will get multiple results online for the same. You need to check out the source of the information provided before relying on it, as people have tried to manipulate it.

Always go for the links to the official websites and cross-check the information twice to be aware of fraud and other illegal activities. Google Pay Customer Care Numbers are also mentioned below for your convenience: 1-800-419-0157. You can contact this number for any queries between 8:00 a.m. and 1:00 p.m.