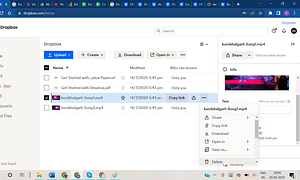

How simple and feasible it is that you can send your money like you send a text message! In September 2016, UPI-based apps, including Phonepe and others, hit the Play Store and have been available for its users. Initially, not all the banks were present on this platform.

Still, with the increased search, use, and popularity of these apps, most banks have registered themselves with the platform, as the future of monetary transactions lies here. The current limit per UPI transaction has been increased to one lakh.

There are some facts about this payment method that you need to be aware of for easy transactions. These apps, especially PhonePe, also give you PhonePe customer care number options to get answers to all your queries.

- The necessity of the app:

It is often asked to download the UPI-based app, whichever looks feasible. Is it necessary to have an app? If you have a bank account, a smartphone, and a registered mobile number, you are just a step away from using these platforms, downloading the app, and linking your account to it. But you need to note that you can only link your bank accounts to these apps and e-wallets. The app is available both for Android and iOS users.

- Registrations:

Yes, it is essential to register yourself with these apps, which is done at abc@bankname. This is easier to remember, and it will also help you keep your information hidden from the other party. There are two options available in it: if the receiver sends you their bank details, like account number, IFSC code, and others, then they need not be registered to UPI, and the other one is easier, simply by transferring through the created ID.

- The risk with the phone:

Some people have this query: now that all their data is linked and stored on the phone, what if their phone is lost or stolen? All their data entered in these apps will be at risk.

To get it solved, you need to block your number as soon as possible so that no one can use it. Secondly, no one can transfer the money from these apps until they have access to your MPIN. So, it would be best if you did not worry, as these apps will secure your data.

- Incomplete Transactions:

Being a digital app, there are possibilities sometimes that the money has been debited from your bank account but isn’t credited to the beneficiary’s account. In this case, the amount will automatically be credited back to the other party’s account within a few minutes, and in case it is not, you can raise a complaint and check out your transaction history on the app. But once you have made the transactions, they cannot be reversed.

- Re-Register:

In case you have changed your UPI app, got a new number, changed your phone, or changed your ID, you need to re-register yourself with the app for security purposes. If you do not remember your MPIN, you can generate a new one with your registered phone number.

How do I know about the Phonepe customer care number?

All these UPI-based apps have an online help center, which you can go through in case of any confusion. Phonepe too has a Phonepe customer care number, which users can contact to get help whenever needed.

Also, to get more information about these apps, you can head over to their social media accounts and check out their posts. All the related information can be found there, be it about their coupons or the new add-ons.